The new no-pay Request for Anticipated Payment (RAP) requirement is perhaps the most notable change home health agencies have had to prepare for in compliance with the CY2021 Home Health Final Rule, which took effect January 1st.

As agencies are getting into the rhythm of the new timeline for no-pay RAPs, more questions and challenges are expected to arise. Here are some tips from industry experts that can actually work:

1. Know your EMR

Agencies need to get acquainted with their EMR’s workflow changes and new requirements about generating RAPs, payor set up, and other related processes. The updates should include mechanisms to help agencies manage timely RAP submissions and prevent chances of delays.

2. Coordinate your clinical and revenue cycle functions

Patient admissions and RAP timelines should be coordinated between clinical and revenue cycle teams. Once a patient admission is completed, the billing team must be informed of the RAP submission and acceptance timeframe to avoid delays. The 3% penalty may not sound intimidating but the delay can really hurt the agency’s cashflow. Remember that the penalty for late submission of no-pay RAPs starts the count from the first day of the 30-day period, NOT the first day after the agency missed the deadline.

3. Use a default HIPPS code

No-pay RAPs only need a primary diagnosis to generate the Health Insurance Prospective Payment System (HIPPS) code; however, agencies may opt to use a default HIPPS code when a complete OASIS is not available to calculate the actual HIPPS value.

NOTE: Industry experts advise against using a default HIPPS code all the time. If it is inevitable to use a default HIPPS code, use a low-value code such as 1AA11.

4. Submit two RAPs at once

If the agency anticipates billing two payment periods within one 60-day care period, it is recommended to submit both RAPs at the same time. When a plan of care dictates multiple 30-day periods of care are required to effectively treat a patient, agencies are allowed to submit no-pay RAPs for both the first and second 30-day periods of care (for a 60-day certification) at once, to help to reduce administrative burden.

The ‘from date’ on the RAP can also also be considered as the ‘service date’ associated with revenue code 0023 —essentially, this gives reassurance for agencies to not incur penalties if the second period’s first billable visit happens beyond the 5-day window. Moreover, the previous criterion that matches the first service date on the RAP versus the first service date on the final claim no longer applies.

5. Keep tabs on the Patient Admission Date

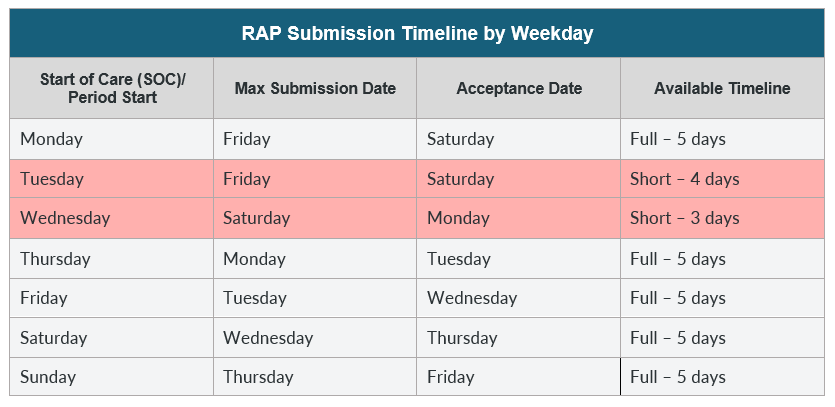

Always remember that the ‘from date’ on the claim (the first date of the payment period) is day 0. For a RAP to be considered timely, it needs to be accepted by the MAC by day 6— or 5 days after the ‘from date’.

NOTE: Generally, the Fiscal Intermediary Standard System (FISS) is not open on Sundays and holidays— this practically means that submission timelines can vary based on which day of the week has the patient admission been accepted. Refer to the timetable below assuming the agency submits a day before day 5 (or the last day of timely acceptance).

Success in the new RAP filing method depends on developing a mindset of streamlining the documentation, adhering to strict timelines, and adopting smarter, more efficient workarounds. On the other hand, while agencies should keep an eye on documentation priorities, it is equally important that patient care should be kept in check and constantly improved.